GMFEC Annual Report Presented to County CommissionersTrustee Regina Morrison Newman, the President/CEO of the RISE Foundation, and the Grants Manager for the Women's Foundation of Greater Memphis presented the GMFEC annual report to the Shelby County Board of Commissioners today. The results received high praise from the commissioners present and a promise to continue to support the mission of the GMFEC.

| |||||||

Shelby County Trustee Announces Over $500,000 In Debt Reduction By Clients Of Greater Memphis Financial Empowerment Center

Regina Morrison Newman, Shelby County Trustee, Announces Milestones Met By The Greater Memphis Financial Empowerment Center; GMFEC Counseling Is Now Officially A Shelby County Benefit

09/22/20 – Regina Morrison Newman, Shelby County Trustee, in partnership with non-profit service provider the RISE Foundation, announced today two critical milestones met by the Greater Memphis Financial Empowerment Center (GMFEC). The GMFEC opened its doors a little over one year ago.

The GMFEC provides free, professional one-on-one financial counseling as a service to any County resident. It has now served over 500 clients and those clients have jointly reduced their non-mortgage debt by over $500,000 as of the end of August. On average, clients receive at least 2 hours of free financial counseling each but are entitled to receive counseling as long as they need it. These milestones are especially meaningful as the GMFEC counselors have been operating fully remotely for the last 6 months due to the COVID-19 pandemic.

Also, in a partnership with Shelby County Mayor Lee Harris, the GMFEC is now an official benefit for County employees, their families and retirees. While counseling is offered to all Shelby County residents free of charge, the GMFEC will dedicate a counselor to County employees as demand increases. When in person counseling is available again, a co-location in a Shelby County building will be established.

“The Trustee’s Office is thrilled with the success clients have been able to achieve through counseling with the GMFEC! To see that debt reduction in the face of the pandemic speaks to their hard work to improve their financial footing. Now to have the GMFEC as an official County benefit raises the awareness of the availability of this tremendous asset. We’ve already seen an uptick in calls from County employees.” - Regina Morrison Newman, Shelby County Trustee

“COVID-19 has underscored the critical importance of professional one-on-one financial counseling to help residents – including County employees – manage the financial impact of the pandemic,” said Jonathan Mintz, President and CEO of the Cities for Financial Empowerment Fund. “We are thrilled to partner with Shelby County and Trustee Newman on the GMFEC, and applaud the work they’ve done over the past year and during the pandemic to build residents’ financial stability.

About the Greater Memphis Financial Empowerment Center

The GMFEC offers free, one-on-one professional financial counseling to all Shelby County residents.

Certified financial counselors are available for personalized guidance and can help you deal with a wide range of personal financial issues including budgeting, debt reduction, credit improvement and increasing savings. Services are always free and available to all Shelby County residents regardless of income. For more information, please visit www.gmfec.org or find us on Facebook (Greater Memphis Financial Empowerment Center. The GMFEC is essentially grant and donation funded, with initial funds from the CFE Fund, and is sponsored by the Shelby County Trustee.

About the Cities for Financial Empowerment Fund (CFE Fund)

The CFE Fund supports municipal efforts to improve the financial stability of households by leveraging opportunities unique to local government. By translating cutting edge experience with large scale programs, research, and policy in cities of all sizes, the CFE Fund assists mayors and other local leaders in over 100 cities to identify, develop, fund, implement, and research pilots and programs that help families build assets and make the most of their financial resources. For more information, please visit www.cfefund.org or follow us on Twitter at @CFEFund.

About the Shelby County Trustee’s Office

The Shelby County Trustee collects County property taxes and handles delinquent property tax collections for all municipalities in Shelby County. By law, the Trustee is the banker for Shelby County Government. In addition, the Trustee coordinates banking services for approximately fifteen different county offices, including various elected officials and the Shelby County Board of Education. The Shelby County Trustee’s duties include maximizing interest earnings and streamlining banking costs. The Trustee offers a number of community outreach programs including Tax Freeze, Tax Relief, Quarterly Tax Payments, Project HOME, Bank On Memphis, On My Own Financial Simulation and the Greater Memphis Financial Empowerment Center. For more information, please visit www.shelbycountytrustee.com.

Regina Morrison Newman, Shelby County Trustee, Announces Milestones Met By The Greater Memphis Financial Empowerment Center; GMFEC Counseling Is Now Officially A Shelby County Benefit

09/22/20 – Regina Morrison Newman, Shelby County Trustee, in partnership with non-profit service provider the RISE Foundation, announced today two critical milestones met by the Greater Memphis Financial Empowerment Center (GMFEC). The GMFEC opened its doors a little over one year ago.

The GMFEC provides free, professional one-on-one financial counseling as a service to any County resident. It has now served over 500 clients and those clients have jointly reduced their non-mortgage debt by over $500,000 as of the end of August. On average, clients receive at least 2 hours of free financial counseling each but are entitled to receive counseling as long as they need it. These milestones are especially meaningful as the GMFEC counselors have been operating fully remotely for the last 6 months due to the COVID-19 pandemic.

Also, in a partnership with Shelby County Mayor Lee Harris, the GMFEC is now an official benefit for County employees, their families and retirees. While counseling is offered to all Shelby County residents free of charge, the GMFEC will dedicate a counselor to County employees as demand increases. When in person counseling is available again, a co-location in a Shelby County building will be established.

“The Trustee’s Office is thrilled with the success clients have been able to achieve through counseling with the GMFEC! To see that debt reduction in the face of the pandemic speaks to their hard work to improve their financial footing. Now to have the GMFEC as an official County benefit raises the awareness of the availability of this tremendous asset. We’ve already seen an uptick in calls from County employees.” - Regina Morrison Newman, Shelby County Trustee

“COVID-19 has underscored the critical importance of professional one-on-one financial counseling to help residents – including County employees – manage the financial impact of the pandemic,” said Jonathan Mintz, President and CEO of the Cities for Financial Empowerment Fund. “We are thrilled to partner with Shelby County and Trustee Newman on the GMFEC, and applaud the work they’ve done over the past year and during the pandemic to build residents’ financial stability.

About the Greater Memphis Financial Empowerment Center

The GMFEC offers free, one-on-one professional financial counseling to all Shelby County residents.

Certified financial counselors are available for personalized guidance and can help you deal with a wide range of personal financial issues including budgeting, debt reduction, credit improvement and increasing savings. Services are always free and available to all Shelby County residents regardless of income. For more information, please visit www.gmfec.org or find us on Facebook (Greater Memphis Financial Empowerment Center. The GMFEC is essentially grant and donation funded, with initial funds from the CFE Fund, and is sponsored by the Shelby County Trustee.

About the Cities for Financial Empowerment Fund (CFE Fund)

The CFE Fund supports municipal efforts to improve the financial stability of households by leveraging opportunities unique to local government. By translating cutting edge experience with large scale programs, research, and policy in cities of all sizes, the CFE Fund assists mayors and other local leaders in over 100 cities to identify, develop, fund, implement, and research pilots and programs that help families build assets and make the most of their financial resources. For more information, please visit www.cfefund.org or follow us on Twitter at @CFEFund.

About the Shelby County Trustee’s Office

The Shelby County Trustee collects County property taxes and handles delinquent property tax collections for all municipalities in Shelby County. By law, the Trustee is the banker for Shelby County Government. In addition, the Trustee coordinates banking services for approximately fifteen different county offices, including various elected officials and the Shelby County Board of Education. The Shelby County Trustee’s duties include maximizing interest earnings and streamlining banking costs. The Trustee offers a number of community outreach programs including Tax Freeze, Tax Relief, Quarterly Tax Payments, Project HOME, Bank On Memphis, On My Own Financial Simulation and the Greater Memphis Financial Empowerment Center. For more information, please visit www.shelbycountytrustee.com.

| gmfec_milestone_press_release_09.22.20.pdf | |

| File Size: | 640 kb |

| File Type: | |

REGINA MORRISON NEWMAN, SHELBY COUNTY TRUSTEE ANNOUNCES LAUNCH OF LOCAL CONSUMER FINANCIAL PROTECTION PLANNING EFFORTS, BEGINNING WITH PROTECTION AGAINST FINANCIAL PREDATORS AND SCAMS AMIDST COVID-19

FOR IMMEDIATE RELEASE

MEDIA CONTACTS:

Molly Polatty, [email protected], (901) 222-0206

Marnie Stewart, [email protected], (901) 222-0209

Memphis, TN, JULY 1, 2020 – Regina Morrison Newman, Shelby County Trustee announced today the launch of local consumer financial protection planning efforts in partnership with the national nonprofit organization the Cities for Financial Empowerment Fund (CFE Fund) and the Annie E. Casey Foundation. A grant will allow Shelby County to plan a communications campaign to raise consumer awareness of and protect residents from COVID-19 related scams, and plan for broader consumer financial protection capabilities within the county in the coming months.

“I’m pleased to add consumer financial protection to our arsenal of programs to help Shelby County residents improve their financial footing which include the Greater Memphis Financial Empowerment Center, Bank on Memphis, and Project HOME. We received word of this grant just as COVID-19 hit, so we decided to do battle with COVID-19 related scams as our initial project. People are more vulnerable than usual right now due to the pandemic. We want to make them aware of trending COVID-19 scams to avoid additional financial or emotional stress. We will be convening a task force to strengthen consumer financial protection in this county.” Regina Morrison Newman, Shelby County Trustee

Shelby County joins Chattanooga, TN; Detroit, MI; Philadelphia, PA; and St. Paul, MN as the second cohort of the CFE Fund’s Local Consumer Financial Protection Initiative, which supports local governments across the country in developing and enhancing their capacity to offer their residents consumer financial protection and empowerment. Shelby County will work with the CFE Fund to plan for a local consumer protection agency, which will strengthen local citizens’ financial empowerment by protecting consumer assets through licensing, regulation, enforcement, mediation, and outreach and education.

Shelby County has received $10,000 as a planning grant, paired with a nine-month technical assistance engagement partnership, to plan for a local consumer financial protection initiative. This process will include a structured approach to identifying critical local consumer issues, convening key stakeholders, and surveying the legal landscape to aid the development of an actionable strategic plan.

“It is an unfortunate reality that predatory actors look to take advantage of vulnerable people during times of crisis like the current COVID-19 pandemic. Examples of scams, frauds, deceptive advertising, and price gouging are already occurring across the country,” said Jonathan Mintz, CFE Fund President and CEO, “Local governments have a critical role to play in protecting residents’ hard-earned assets, and we are thrilled to partner with Trustee Newman on this important work.”

In 2017, with the support of both the Annie E. Casey Foundation and the W.K. Kellogg Foundation, the CFE Fund selected 4 cities through the Local Consumer Financial Protection Initiative to build out their own consumer financial protection offices within their mayors’ administrations. These cities (Albuquerque, NM; Denver, CO; Nashville, TN; and Salt Lake City, UT) have each successfully launched their efforts, developing consumer complaint infrastructure, identifying enforcement priorities, and pursuing legislative reforms.

FOR IMMEDIATE RELEASE

MEDIA CONTACTS:

Molly Polatty, [email protected], (901) 222-0206

Marnie Stewart, [email protected], (901) 222-0209

Memphis, TN, JULY 1, 2020 – Regina Morrison Newman, Shelby County Trustee announced today the launch of local consumer financial protection planning efforts in partnership with the national nonprofit organization the Cities for Financial Empowerment Fund (CFE Fund) and the Annie E. Casey Foundation. A grant will allow Shelby County to plan a communications campaign to raise consumer awareness of and protect residents from COVID-19 related scams, and plan for broader consumer financial protection capabilities within the county in the coming months.

“I’m pleased to add consumer financial protection to our arsenal of programs to help Shelby County residents improve their financial footing which include the Greater Memphis Financial Empowerment Center, Bank on Memphis, and Project HOME. We received word of this grant just as COVID-19 hit, so we decided to do battle with COVID-19 related scams as our initial project. People are more vulnerable than usual right now due to the pandemic. We want to make them aware of trending COVID-19 scams to avoid additional financial or emotional stress. We will be convening a task force to strengthen consumer financial protection in this county.” Regina Morrison Newman, Shelby County Trustee

Shelby County joins Chattanooga, TN; Detroit, MI; Philadelphia, PA; and St. Paul, MN as the second cohort of the CFE Fund’s Local Consumer Financial Protection Initiative, which supports local governments across the country in developing and enhancing their capacity to offer their residents consumer financial protection and empowerment. Shelby County will work with the CFE Fund to plan for a local consumer protection agency, which will strengthen local citizens’ financial empowerment by protecting consumer assets through licensing, regulation, enforcement, mediation, and outreach and education.

Shelby County has received $10,000 as a planning grant, paired with a nine-month technical assistance engagement partnership, to plan for a local consumer financial protection initiative. This process will include a structured approach to identifying critical local consumer issues, convening key stakeholders, and surveying the legal landscape to aid the development of an actionable strategic plan.

“It is an unfortunate reality that predatory actors look to take advantage of vulnerable people during times of crisis like the current COVID-19 pandemic. Examples of scams, frauds, deceptive advertising, and price gouging are already occurring across the country,” said Jonathan Mintz, CFE Fund President and CEO, “Local governments have a critical role to play in protecting residents’ hard-earned assets, and we are thrilled to partner with Trustee Newman on this important work.”

In 2017, with the support of both the Annie E. Casey Foundation and the W.K. Kellogg Foundation, the CFE Fund selected 4 cities through the Local Consumer Financial Protection Initiative to build out their own consumer financial protection offices within their mayors’ administrations. These cities (Albuquerque, NM; Denver, CO; Nashville, TN; and Salt Lake City, UT) have each successfully launched their efforts, developing consumer complaint infrastructure, identifying enforcement priorities, and pursuing legislative reforms.

| cfpi_shelby_county_release_-_july_2020.pdf | |

| File Size: | 584 kb |

| File Type: | |

GMFEC Results Continue to Mount

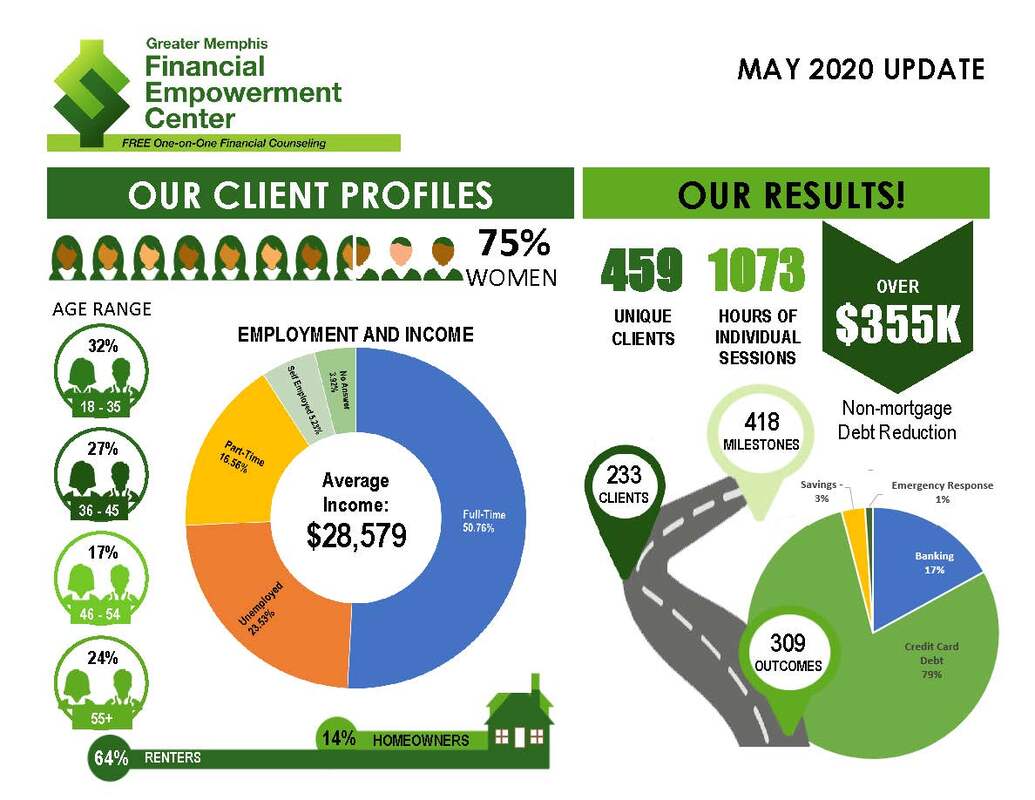

Results through May 2020 show our counselors continue to help their clients improve their financial footing despite the pandemic.

Counselors continue to operate remotely meeting with clients via telephone or video chat. In addition to helping people rethink their pandemic budgets to account for income changes, negotiating with creditors and opening a safe affordable banking relationship, they can make referrals to pandemic related resources for unemployment assistance, job search assistance, stimulus assistance, rental and utility payment assistance and eviction help.

To make a free one-on-one counseling appointment, please call (901) 390-4200 or click the link below.

https://fecpublic.org/appointment-greatermemphis

Results through May 2020 show our counselors continue to help their clients improve their financial footing despite the pandemic.

Counselors continue to operate remotely meeting with clients via telephone or video chat. In addition to helping people rethink their pandemic budgets to account for income changes, negotiating with creditors and opening a safe affordable banking relationship, they can make referrals to pandemic related resources for unemployment assistance, job search assistance, stimulus assistance, rental and utility payment assistance and eviction help.

To make a free one-on-one counseling appointment, please call (901) 390-4200 or click the link below.

https://fecpublic.org/appointment-greatermemphis

The Results are In!

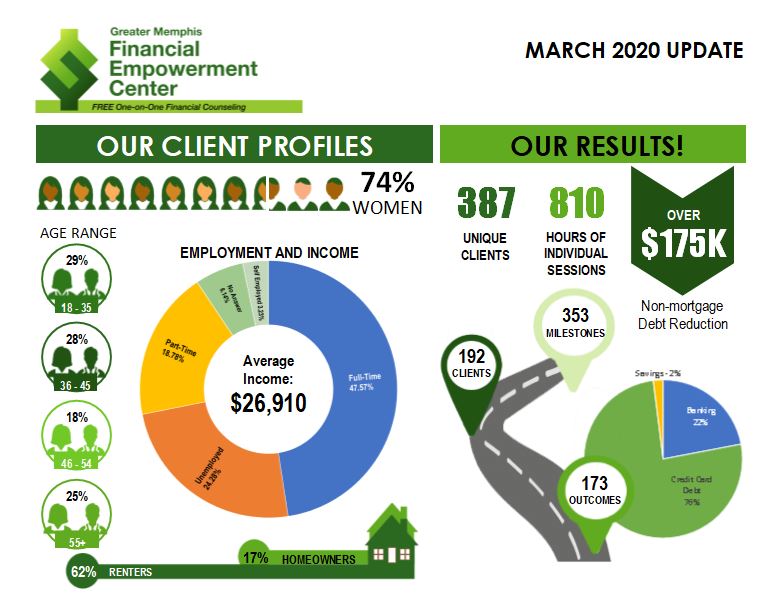

The GMFEC is happy to share results of our first year helping Shelby County Residents improve their financial footing.

While we are in the midst of this pandemic and time of social distancing, our counselors remain committed to helping anyone who needs it. They continue meeting with clients via telephone and video chat. Their focus continues to be whatever their client needs. What we have found during the pandemic is clients needing assistance with expediting their economic stimulus money and/or unemployment assistance.

Our counselors are well versed in helping clients navigate the various websites and help them get a safe, affordable bank account opened with one of our Bank on Memphis financial partners negotiating new terms or deferrals with creditors including mortgage lenders, auto lenders, student loan holders and credit card companies referral for direct services from our vast network of community partners

If you would like to schedule an appointment, simply call (901) 390-4200 or click on the link below.

https://fecpublic.org/appointment-greatermemphis

The GMFEC is happy to share results of our first year helping Shelby County Residents improve their financial footing.

While we are in the midst of this pandemic and time of social distancing, our counselors remain committed to helping anyone who needs it. They continue meeting with clients via telephone and video chat. Their focus continues to be whatever their client needs. What we have found during the pandemic is clients needing assistance with expediting their economic stimulus money and/or unemployment assistance.

Our counselors are well versed in helping clients navigate the various websites and help them get a safe, affordable bank account opened with one of our Bank on Memphis financial partners negotiating new terms or deferrals with creditors including mortgage lenders, auto lenders, student loan holders and credit card companies referral for direct services from our vast network of community partners

If you would like to schedule an appointment, simply call (901) 390-4200 or click on the link below.

https://fecpublic.org/appointment-greatermemphis

|

The GMFEC is stepping up to help all citizens of Shelby County who are facing financial strain and uncertanty. If you need help, you can contact one of our counselors and have a FREE and REMOTE one-on-one counseling session. Check out this article from High Ground to find out more!

Check out this article by Memphis Small Business Quarterly about how the GMFEC is available to help entrepreneurs and small businesses. |

|

Fight your own battle with payday lenders by getting free financial counseling as long as you need it at the Greater Memphis Financial Empowerment Center.

Why payday lenders accept millions in MLGW payments: ‘It gets people into the store.’ - MLGW is among many utilities across the South, public and private, that offer payment locations in a payday lender. In this case, 30 ACE Cash Express stores.

Check out this story on commercialappeal.com: https://www.commercialappeal.com/…/mlgw-bill-pa…/4596681002/ |

Trustee Newman and GMFEC joins MLK Days of Service with the Passport to Financial Fitness

Regina Morrison Newman, the Shelby County Trustee, in partnership with the Bank On Memphis program and the Greater Memphis Financial Empowerment Center (GMFEC) are offering a drop in event called the Passport to Financial Fitness on Saturday, January 18, 2020 from 10:00 a.m. – 1:00 p.m. in the meeting rooms at the Benjamin Hooks Library (3030 Poplar Ave. 38111).

Regina Morrison Newman, the Shelby County Trustee, in partnership with the Bank On Memphis program and the Greater Memphis Financial Empowerment Center (GMFEC) are offering a drop in event called the Passport to Financial Fitness on Saturday, January 18, 2020 from 10:00 a.m. – 1:00 p.m. in the meeting rooms at the Benjamin Hooks Library (3030 Poplar Ave. 38111).

The event will provide experts on a variety of topics where people might be experiencing financial stress coming out of the holidays into the new year. Topics and experts include:

|

|

Trustee Regina Morrison Newman and Linda Williams on Bluff City Life

The Trustee on Bluff City Life with Linda Williams (RISE Foundation) talking about the GMFEC and this Saturday's Passport to Financial Fitness https://www.wmcactionnews5.com/…/…/bluff-city-life-jan-part/ |

|

RISE Foundation hosts a Spectacular Gala

Shelby County Trustee Regina Morrison Newman, Women's Foundation's Ruby Bright and RISE Foundation's Linda Williams enjoy the Night Under the Big Top at the RISE Foundation's Annual Gala. These three ladies are the HEART of the GMFEC and have joined together to bring one-on-one FREE financial counseling to Shelby County! |

|

GMFEC Partners with Community Non-Profits to Host Greater Memphis Housing FairSaturday, October 26, 2019

10am - 2pm GMFEC will provide opportunities to review credit reports and FICO scores. For more information or to Register for the event - CLICK HERE | ||||||

Check out the Trustee's Segment on Power Up Memphis with Gale Jones-CarsonFollow this link to the Interview about the GMFEC!

|

Financial Help Now Available for All Shelby County ResidentsBy Linda Moore, Daily Memphian

July 16, 2019 Shelby County residents now have a place to go for financial counseling that’s free to everyone regardless of income and available for as long as they need it. The Greater Memphis Financial Empowerment Center has been open six weeks and on Tuesday hosted a grand opening, which brought in local elected officials, nonprofit organization leaders and other center supporters. “We are just thrilled to open this today. This is a service that Shelby County really needs,” Regina Morrison Newman, county trustee, said. Support in grants and in-kind contributions have come from the city of Memphis, Shelby County government, nonprofit agencies such as the RISE Foundation, United Way of the Mid-South, The Women's Foundation for a Greater Memphis, the Assisi Foundation of Memphis and the Cities for Financial Empowerment Fund, which is supported by Bloomberg Philanthropies. The grant request to the CFE was submitted by former trustee David Lenoir, and that work is coming to fruition, Newman said. “The whole point of the program is it’s not a program. It’s help for as long as people need it. It is free, one-on-one financial counseling for any Shelby County resident,” Newman said. The center is Downtown at 254 Court Ave., but there are other co-location sites. And the four trained counselors are mobile. “We can go where they are financially and physically,” Newman said. The center now has 85 clients and is prepared to help with banking, establishing and maintaining credit, debt reduction and saving. This year's budget is about $400,000, Newman said. The CFE will award the Shelby County center $250,000 for this year and next year, she said. Government can’t solve all of the community’s problems, Memphis Mayor Jim Strickland said. The team brought together for this project will help families and individuals achieve long-term financial stability, Strickland said. “This effort will embed financial empowerment strategies into their lives,” he said. What’s needed now is to spread the word, Strickland said. “If we were in church, I would ordain all of you,” he said. “We need evangelists out there. We need a line outside these doors of people trying to get in here.” There is a real need for financial literacy and education across the county, County Mayor Lee Harris added. “We see it in all walks and all kinds of places,” said Harris, who noted that even county government employees are not taking advantage of available opportunities to save for retirement. The first financial empowerment center opened in New York City under former Mayor Michael Bloomberg, said John Murphy, a principal with the CFE, which provides grants and technical support. Over the past nine years, six other cities, including Nashville, have been participants in the program, Murphy said. In Nashville, they worked with about 5,000 people who collectively were able to retire about $7 million in debt, save about $1 million and on average and raise their credit scores by 35 points. A 35-point increase in a credit score can amount to hundreds or thousands of dollars on a car loan, Murphy said. This program empowers consumers to make sound financial decisions, he said. “When people are sick, they don’t go to a workshop on health. They go to see a doctor,” Murphy said. “And financial counseling is a lot like going to see a doctor.” When a client meets with a counselor, the first thing they go through is a financial health assessment, which helps diagnose what the issues are, he said. “And based on that diagnosis, the counselor is going to prescribe the right course of action in order to ensure greater financial health,” Murphy said. The center is at 254 Court Ave., Suite 100. Hours are 9 a.m.-5 p.m. Mondays and Wednesdays and 9 a.m. to 7 p.m. Tuesdays and Thursdays. https://dailymemphian.com/section/metroshelby-county/article/6229/Free |